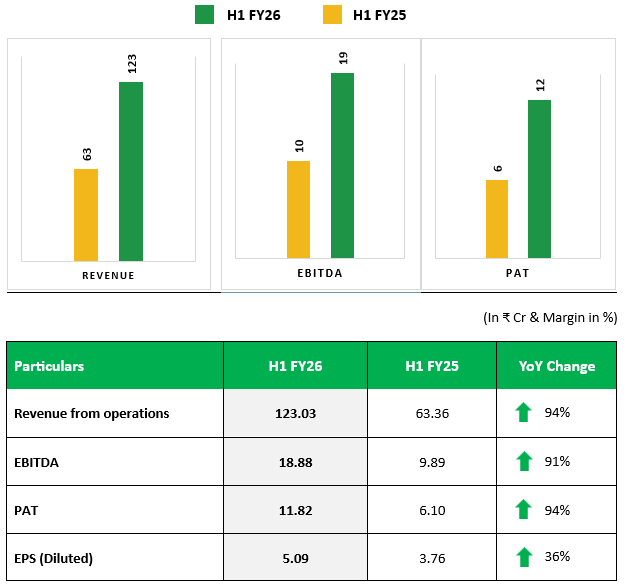

Sugs Lloyd Limited Reports 91% Growth in EBITDA and 94% Growth in PAT for H1 FY26

Nov 14, 2025

VMPL

Noida (Uttar Pradesh) [India], November 14: Sugs Lloyd Limited (BSE - SME: 544501), a leading power infrastructure and EPC solutions company, has announced its unaudited financial results for the half year ended 30th September, 2025.

KEY FINANCIAL HIGHLIGHTS (Standalone)

ORDER BOOK HIGHLIGHTS (AS ON SEPTEMBER 30, 2025)

* Robust Order Book: ₹409.59 crore, providing 24-30 months of strong execution visibility through FY27.

* Diversified Portfolio: Solar - ₹288.03 crore | Electrical - ₹113.97 crore | Civil - ₹7.59 crore.

* Healthy Growth Pipeline: ₹800+ crore in qualified bids under evaluation with 20-30% expected conversion.

* Scaling for Growth: New ₹1,000 crore bidding capacity to unlock next phase of expansion.

MANAGEMENT PERSPECTIVE

Commenting on the company's performance, Mr. Santosh Shah, Chairman and Promoter of Sugs Lloyd Limited, said:

"We are delighted to deliver another period of solid performance, achieving 94% growth in revenue and a near doubling of profit on a half-yearly basis. The results reflect our strong execution capabilities and operational discipline across electrical and solar EPC verticals. Our robust order book of over ₹400 crore and expanding presence across multiple states provide long-term visibility and confidence in our growth trajectory."

"With our 50%+ market share in Fault Passage Indicator (FPI) technology and enhanced financial flexibility post-IPO, Sugs Lloyd is well-positioned to capitalize on India's growing power infrastructure investments. We remain focused on strengthening our execution capacity, improving margins, and creating sustainable value for all stakeholders."

ABOUT SUGS LLOYD LIMITED

Sugs Lloyd Limited is a leading EPC company engaged in electrical, solar, and smart grid solutions across India. Established in 2009, the company has evolved into a trusted partner for power infrastructure projects under schemes such as RDSS, IPDS, and PM-KUSUM. With a robust order book of ₹409 crore and strong execution capabilities, Sugs Lloyd serves blue-chip clients including NTPC, Tata Power, and several state DISCOMs.

The company holds over 50% market share in Fault Passage Indicator (FPI) technology and continues to expand in the solar EPC and O&M segments.

For FY25, the company reported revenue from operations of ₹176 crore, EBITDA of ₹26 crore, and Net Profit of ₹17 crore.

DISCLAIMER

This document contains forward-looking statements, which are not historical facts and are subject to risks and uncertainties such as government actions, local developments, and technological risks. The Company is not responsible for any actions taken based on these statements and does not commit to publicly updating them to reflect future events or circumstances.

(ADVERTORIAL DISCLAIMER: The above press release has been provided by VMPL. ANI will not be responsible in any way for the content of the same.)